Andersen Piterbarg Interest Rate Modeling Pdf Editor

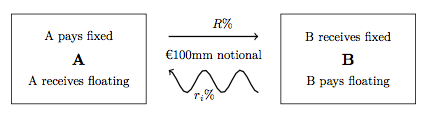

Finally for students interested in cutting edge modeling the three volume book Andersen & Piterbarg (2010a), Andersen & Piterbarg (2010b) and. Rate Swap (IRS). This a bilateral contract between two counterparties to exchange a series of fixed interest rate payments for a series of floating interest rate payments over.

The three volumes of Interest Rate Modeling present a comprehensive and up-to-date treatment of techniques and models used in the pricing and risk management of fixed income securities. Written by two leading practitioners and seasoned industry veterans, this unique series combines finance theory, numerical methods, and approximation techniques to provide the reader with an integrated approach to the process of designing and implementing industrial-strength models for fixed income security valuation and hedging.

Aiming to bridge the gap between advanced theoretical models and real-life trading applications, the pragmatic, yet rigorous, approach taken in this book will appeal to students, academics, and professionals working in quantitative finance. Volume I provides the theoretical and computational foundations for the series, emphasizing the construction of efficient grid- and simulation-based methods for contingent claims pricing. The second part of Volume I is dedicated to local-stochastic volatility modeling and to the construction of vanilla models for individual swap and Libor rates.

Although the focus is eventually turned toward fixed income securities, much of the material in this volume applies to generic financial markets and will be of interest to anybody working in the general area of asset pricing.

• • • This article is within the scope of, a collaborative effort to improve the coverage of articles related to on Wikipedia. If you would like to participate, please visit the project page, where you can join the and see a list of open tasks. This article has been rated as C-Class on the project's. This article has been rated as High-importance on the project's. (Rated C-class, Low-importance) Business Wikipedia:WikiProject Business Template:WikiProject Business WikiProject Business articles.

Contents • • • • • • • • • • PROJECT FINANCE [ ] This article is part of project finance and has recently been part of a wide review of interest rate derivative amendments. Some very old comments on this talk page have now been removed as either now obsolete or addressed. Below talk comments have been left temporarily for further consideration ahead of deletion. Users with new comments about this article please submit below within section new comments. () 08:31, 3 July 2017 (UTC) New Comments [ ] Old Comments pending deletion on 1st July 2018 [ ].

Extended content Adding an external link to this article [ ] I would like to add an external link to however this could be violating point 11 of the 'links to normally be avoided' in the external links guidelines. This isn't a blog much as it is a growing list of articles we are creating sharing 15 years inside investment banking. Pressreader Crack Download. This one I felt complemented the article however contains multimedia so I cannot add it straight in. Anyway what are the feelings on my adding the external link to this article as I would like to respect the culture of wikipedia and it could represent a conflict of interest as we sell an app on the iPad ( but I am not linking to this of course). () 13:58, 17 August 2012 (UTC) Most swaps are interest rates swaps per ISDA [ ] The ISDA semi annual survery shows that the plain vanilla interest rate swap exceeds other derivatives by far.

Why does this article say that most swaps have a fixed equity leg? The only possible reason is that there is option pricing model shown as a reference and they work best with equities. But the fact is that equity derivatives lag far behind interest rate swaps in volume.

Probably because of the narrow perspective of the writer. I know in the past I have written things from a pure IR derivatives point of view and then realised (or been told) later what a narrow view I espoused. Feel free to change things so that they are right. 11:42, 11 Dec 2004 (UTC) Removed Tax Purposes Section [ ] Another common use of the swap was to avoid the British on short sales. Unlike the in the US, in the UK only the short sells are taxed, and in order to raise enough money to pay for the exchange, taxed at a fairly high rate. To avoid this tax it is possible to simply swap out a position, paying a small fee to the other counterparty instead of a larger fee to the British exchanges.

This whole section is inaccurate. Firstly, the UK stamp duty applies on equity purchases, not sales. Thus, in a short sale it applies on the close-out of the position.

The money raised is not used to 'pay for the exchange', it's levied by the UK government under the Finance Act 1986 (see the entry on for more). Finally, the instrument used to avoid paying Stamp Duty on purchases is an. I added these two items to the See Also section.-- 23:33, 23 Apr 2005 (UTC) It would actually be nice if this whole article had a section on the HISTORY of interest rate swaps: how, when, and why did such a complicated financial instrument emerge. The historical dimension is important, I think, if for no other reason than the fact that exploitative swaps have been implicated in the budgetary disaster of Jefferson County, Alabama; and several city and national governments in Europe. —Preceding comment added by () 20:42, 15 September 2010 (UTC) Clarifying the Math in Introductory Paragraphs [ ] As a newcomer to swaps, I cannot make the net payment amount of 1.70% square with the 3.00% swap rate and the variable rate of (LIBOR + 50 bps)if LIBOR = 1.30% in the following paragraph: Consider the following swap in which Party A agrees to pay Party B periodic fixed interest rate payments of 3.00%, in exchange for periodic variable interest rate payments of LIBOR + 50 bps (0.50%). Note that there is no exchange of the principal amounts and that the interest rates are on a 'notional' (i.e. Imaginary) principal amount.

Also note that the interest payments are settled in net (e.g. If LIBOR is 1.30% then Party B receives 1.70% (LIBOR + 50bps) and Party A pays 1.70%). The fixed rate (3.00% in this example) is referred to as the swap rate.[1] It seems to me that LIBOR + 50 bps = 1.80% and the net payment would be (3.00% -1.80%) or 1.20%.

Can some veteran clarify this, please? () 15:35, 27 October 2008 (UTC) I agree with Christian, a potentially interesting article but so badly explained in the Structure section that none of the rest of the article has any meaning.

So, consider that I am new to swaps, I'm reading the article because I want to learn about them and yet I have to contend with the following curiosities: 1. In the first figure both parties are shown to win by some positive amount.

If it wasn't meant to show that, e.g. That both parties pay and receive some amount, with the possibility that one party is at a net loss, it should say so. The calculation in the text in the Structure section currently reads: 'Party A pays (LIBOR + 1.50%)+8.65% - (LIBOR+0.70%) = 9.45% net.' Now just think about it, if the variable LIBOR is cancelled out of this equation then Party A's net position is constant regardless of LIBOR, and in fact 9.45% has miraculously been given to them. I think the author didn;t mean 'net' but of course it isn't explained so I can't tell.

The second figure is even funnier. The caption states that 'the bank takes a spread from the swap payments' and yet the net figures have actually increased, at 9. Download Thanks For My Child on this page. 6% and LIBOR + 0.7% respectively, so it can be concluded that the bank makes money from some mysterious fourth source that also dishes out some risk free profit to the counter parties as well. Once again I suspect the author has a specialised definition of net. Hope this helps, I would be interested to see the final explanation. () 07:01, 27 May 2010 (UTC) Interest Rate Swap mis-selling scandal [ ] Am I right in thinking that subject of this article is related to the 'Interest Rate Swap Mis-selling Scandal' (or similar names)?

If so, I think that this article should have a section on it - or possibly it should have its own article. I don't feel I have enough knowledge in this area to start it.

Here are some references:,,, () 18:57, 23 May 2013 (UTC) Uses — not evading exchange controls [ ] >Interest rate swaps were originally created to allow multi-national companies to evade exchange controls. This is unsourced nonsense, so has been deleted. Amongst other problems, IRS wouldn’t be an effective means of avoiding those. If re-adding, please cite reputable source.

() 16:22, 16 February 2014 (UTC) External links modified [ ] Hello fellow Wikipedians, I have just modified 3 external links on. Please take a moment to review. If you have any questions, or need the bot to ignore the links, or the page altogether, please visit for additional information. I made the following changes: • Added archive to • Added archive to • Added archive to When you have finished reviewing my changes, you may follow the instructions on the template below to fix any issues with the URLs. You may set the checked=, on this template, to true or failed to let other editors know you reviewed the change. If you find any errors, please use the tools below to fix them or call an editor by setting needhelp= to your help request.

• If you have discovered URLs which were erroneously considered dead by the bot, you can report them with. • If you found an error with any archives or the URLs themselves, you can fix them with. If you are unable to use these tools, you may set needhelp= on this template to request help from an experienced user. Please include details about your problem, to help other editors. Cheers.— () 19:26, 14 November 2017 (UTC).